By Fortune Kagombe

On DIVINE MAFA’S Vision

For years, Bitcoin has paraded as a “store of value.” Not “digital gold.” That pivot—from peer-to-peer cash to speculative vault—wasn’t evolution. It was erasure.

But what if the real origin of digital gold wasn’t a ghost in a 2008 whitepaper, but a Zimbabwean-American innovator hustling in Memphis during the global financial crash—feeding the homeless with Elvis-backed scrip that moved like text messages before smartphones ruled?

That man is Divine Mafa. And yesterday, he filed a trademark claim with the U.S. Patent and Trademark Office to reclaim “Digital Gold” for what it was always meant to be: a real, gold-backed currency flowing digitally through everyday life.

Not vaporware. Not speculation. But audited bullion—nearly $900 million worth—tokenized for milli-ounce transfers by SMS. Tomatoes at the market. Bus fare. No border barriers.

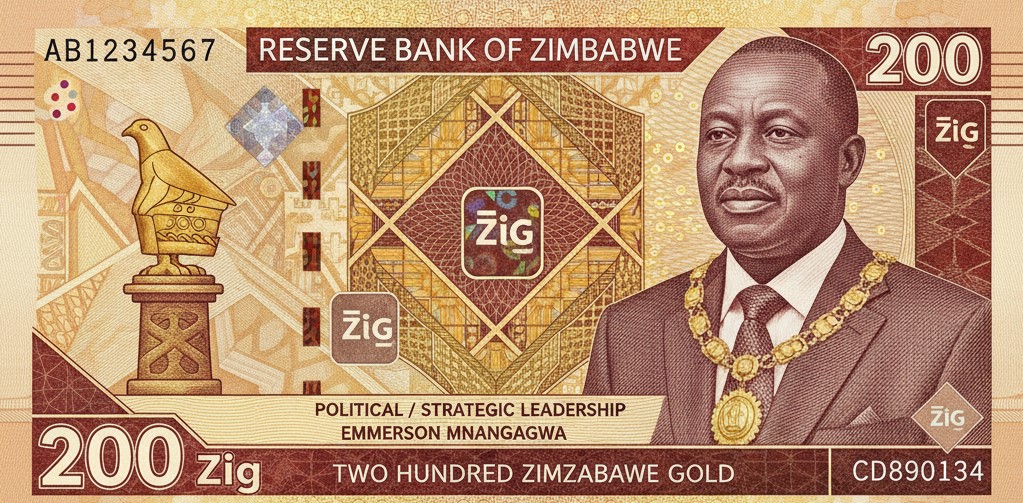

The ZiG Revolution

This isn’t theory. It’s unfolding in Zimbabwe right now.

Since its April 2024 launch, the Zimbabwe Gold (ZiG) currency has surged from 26% to nearly 50% of all national transactions. Frictionless, borderless, and backed by physical gold redeemable as coins, even when the grid goes dark.

Mafa’s cease-and-desist, now viral on X, demands that President Trump, Michael Saylor, Elon Musk, and the broader Bitcoin establishment stop using “digital gold” or face legal and moral reckoning.

The filing cites Mafa’s 2008 Memphis experiments, his continuous innovation leading to ZiG, and a narrow claim over gold-backed financial services—territory no major crypto player has yet owned.

The Misbranding of Bitcoin

Bitcoin’s whitepaper didn’t mention gold once. It was “A Peer-to-Peer Electronic Cash System.”

The “digital gold” rebrand appeared later—around 2013–2015—as BTC shed its payments identity for a “store of value” narrative. That shift accelerated under Michael Saylor’s MicroStrategy crusade, culminating in the firm’s 2025 rebrand to “Strategy”, complete with an orange Bitcoin logo—and the declaration that BTC was the new gold.

But whales didn’t invent that term; they co-opted it.

By scrubbing its origins, they reframed Bitcoin as the superior hedge—while physical gold prices slid six percent after Saylor’s notorious “let their assets go to zero” call.

Zimbabwe’s Counterpoint

Tell that to the Zimbabwean mother sending 0.001 ounces of vaulted bullion via EcoCash SMS to her child’s vendor for a loaf of bread. ZiG isn’t code-wishing—it’s hybrid might.

Quarterly audits. Physical reserves. Forty percent of retail payments already flowing through digital gold channels.

Africa’s mobile money pioneers—M-Pesa chief among them—proved this model in 2007. If gold is real money, it can move digitally. Bitcoin’s purists call that impossible, but their single-chain snobbery ignores real-world innovation from those who’ve waited days for maize in Harare.

Beyond the Hype

When Bitcoin’s creator, Satoshi Nakamoto, vanished in 2011, the network ballooned into a trillion-dollar abstraction. Yet its hype cycles have stripped poorer nations of leverage.

Saylor’s “zero” rhetoric. Musk’s Starlink dominance without grid aid. Trump’s Fort Knox 2.0 Bitcoin reserve pitch. The message to the Global South: sell your gold, trust our code—and lose your sovereignty.

If unchecked, that narrative theft drains meaning from real digital gold systems like ZiG. Despite a 94% depreciation since launch, Zimbabweans keep adopting it.

Why? Because they see the proof of concept—a working hybrid between metal and message.

The Reclamation

Mafa’s filing isn’t a publicity stunt. It’s a restoration.

A fight to reclaim a term and a truth that began in southern Africa, not Silicon Valley. Digital gold isn’t a meme; it’s a mandate for tangible, audited, equitable value transfer.

So, the challenge stands:

• Educate the market.

• Audit Fort Knox openly.

• Correct the credit trail.

• Let gold move like life again.

Bitcoin isn’t the enemy. But its prophets rewrote the script.

Time to reset the narrative—and let Africa mine the truth.